The following scenario relates to questions 6–10.On 1 January 20X5, Blocks Co entered into

The following scenario relates to questions 6–10.

On 1 January 20X5, Blocks Co entered into new lease agreements as follows:

Agreement one This finance lease relates to a new piece of machinery. The fair value of the machine is $220,000. The agreement requires Blocks Co to pay a deposit of $20,000 on 1 January 20X5 followed by five equal annual instalments of $55,000, starting on 31 December 20X5. The implicit rate of interest is 11·65%.

Agreement two This three-year operating lease relates to a fleet of vans. The fair value of the vans is $120,000 and they have an estimated useful life of five years. The agreement requires Blocks Co to make no payment in year one and $48,000 in years two and three.

Agreement three This sale and leaseback relates to a cutting machine purchased by Blocks Co on 1 January 20X4 for $300,000. The carrying amount of the machine as at 31 December 20X4 was $250,000. On 1 January 20X5, it was sold to Cogs Co for $370,000 and Blocks Co will lease the machine back for five years, the remainder of its useful life, at $80,000 per annum.

According to IAS 17 Leases, which of the following is generally considered to be a characteristic of an operating, rather than a finance, lease?

A.Ownership of the assets is passed to the lessee by the end of the lease term

B.The lessor is responsible for the general maintenance and repair of the assets

C.The present value of the lease payments is approximately equal to the fair value of the asset

D.The lease term is for a major part of the useful life of the asset

For agreement one, what is the finance cost charged to profit or loss for the year ended 31 December 20X6?

A.$23,300

B.$12,451

C.$19,607

D.$16,891

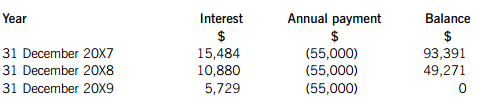

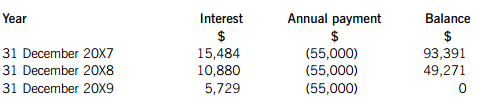

The following calculations have been prepared for agreement one: How will the finance lease obligation be shown in the statement of financial position as at 31 December 20X7?

A.$44,120 as a non-current liability and $49,271 as a current liability

B.$49,271 as a non-current liability and $44,120 as a current liability

C.$93,391 as a non-current liability

D.$93,391 as a current liability

For agreement three, what profit should be recognised for the year ended 31 December 20X5 as a result of the sale and leaseback?A.$24,000

B.$120,000

C.$70,000

D.$20,000

For agreement two, what would be the correct statement of profit or loss entries for the year ended 31 December 20X5?A.Depreciation of $24,000 and no lease rental expense

B.No depreciation and lease rental expense of $32,000

C.Depreciation of $24,000 and lease rental expense of $32,000

D.No depreciation and lease rental expense of $48,000

请帮忙给出每个问题的正确答案和分析,谢谢!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

如果结果不匹配,请 联系老师 获取答案

如果结果不匹配,请 联系老师 获取答案

更多“On 1 October 20X4, Flash Co ac…”相关的问题

更多“On 1 October 20X4, Flash Co ac…”相关的问题