更多“uniform. liability system”相关的问题

更多“uniform. liability system”相关的问题

● () is most closely associated with business risk. ()A. profit and loss B. personnel turnoverC. workmen’s compensation D. liability insurance

A、Its information value is limited.

B、It accounts for the problem of rate-insensitive asset and liability runoffs and prepayments.

C、It accommodates cash flows from off-balance-sheet activities.

D、It helps to determine an FI's profit exposure to interest rate changes.

E、It considers market value effects of interest rate changes.

On 1 October 20X4, Flash Co acquired an item of plant under a five-year lease agreement. The plant had a cash purchase cost of $25m. The agreement had an implicit finance cost of 10% per annum and required an immediate deposit of $2m and annual rentals of $6m paid on 30 September each year for five years.

What is the current liability for the leased plant in Flash Co’s statement of financial position as at 30 September 20X5?

A、$19,300,000

B、$4,070,000

C、$5,000,000

D、$3,850,000

In the mid 1940s, the Second World War came to an end, and denim blue jeans, previously worn almost exclusively as workwear, gained a new status in the U. S. and Europe. Rugged but relaxed, they stood for freedom and a bright future. Sported by both men and women, by returning GI's and sharp teenagers, they seemed as clean and strong as the people who chose to wear them. In Europe, surplus Levi's were left behind by American armed forces and were available in limited supplies. It was the European population's first introduction to the denim apparel. Workwear manufacturers tried to copy the U. S. originals, but those in the know insisted on the real thing.

In the 1950s, Europe was exposed to a daring new style. in music and movies and consequently jeans took on an aura of sex and rebellion. Rock'n'roll coming from America blazed a trail of defiance, and jeans became a symbol of the break with convention and rigid social morals. When Elvis Presley sang in "Jailhouse Rock", his denim prison uniform. carried a potent, virile image. Girls swooned and guys were quick to copy the King. In movies like "The Wild One" and "Rebel Without a Cause" cult figures Marion Brando and James Dean portrayed tough anti-heroes in jeans and T-shirts. Adults spurned the look; teenagers, even those who only wanted to look like rebels, embraced it.

By the beginning of the 1960s, slim jeans had become a leisure wear staple, as teens began to have real fun, forgetting the almost desperate energy of the previous decade, while cocooned (包围在) in wealth and security. But the seeds of change had been sown, and by the mid 1960s jeans had acquired yet another social connotation—as the uniform. of the budding social and sexual revolution. Jeans were the great equalizer, the perfect all-purpose garment for the classless society sought by the Hippy generation. In the fight for civil rights, at anti-war demonstrations off the streets of Paris, at sit-ins and love-ins everywhere, the battle cry was heard above a sea of blue.

Jeans were first designed for ______.

A.soldiers

B.workmen

C.teenagers

D.cowboys

The following scenario relates to questions 11–15.

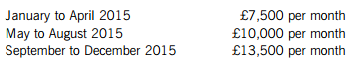

Alisa commenced trading on 1 January 2015. Her sales since commencement have been as follows:

The above figures are stated exclusive of value added tax (VAT). Alisa only supplies services, and these are all standard rated for VAT purposes. Alisa notified her liability to compulsorily register for VAT by the appropriate deadline.

For each of the eight months prior to the date on which she registered for VAT, Alisa paid £240 per month (inclusive of VAT) for website design services and £180 per month (exclusive of VAT) for advertising. Both of these supplies are standard rated for VAT purposes and relate to Alisa’s business activity after the date from when she registered for VAT.

After registering for VAT, Alisa purchased a motor car on 1 January 2016. The motor car is used 60% for business mileage. During the quarter ended 31 March 2016, Alisa spent £456 on repairs to the motor car and £624 on fuel for both her business and private mileage. The relevant quarterly scale charge is £294.

All of these figures are inclusive of VAT. All of Alisa’s customers are registered for VAT, so she appreciates that she has to issue VAT invoices when services are supplied.

From what date would Alisa have been required to be compulsorily registered for VAT and therefore have had to charge output VAT on her supplies of services?

A.30 September 2015

B.1 November 2015

C.1 October 2015

D.30 October 2015

What amount of pre-registration input VAT would Alisa have been able to recover in respect of inputs incurred prior to the date on which she registered for VAT?A.£468

B.£608

C.£536

D.£456

How and by when does Alisa have to pay any VAT liability for the quarter ended 31 March 2016?A.Using any payment method by 30 April 2016

B.Electronically by 7 May 2016

C.Electronically by 30 April 2016

D.Using any payment method by 7 May 2016

Which of the following items of information is Alisa NOT required to include on a valid VAT invoice?A.The customer’s VAT registration number

B.An invoice number

C.The customer’s address

D.A description of the services supplied

What is the maximum amount of input VAT which Alisa can reclaim in respect of her motor expenses for the quarter ended 31 March 2016?A.£108

B.£138

C.£180

D.£125

请帮忙给出每个问题的正确答案和分析,谢谢!

There is no uniform. explanation on what“prompt shipment”or“immediate shipment” means.()

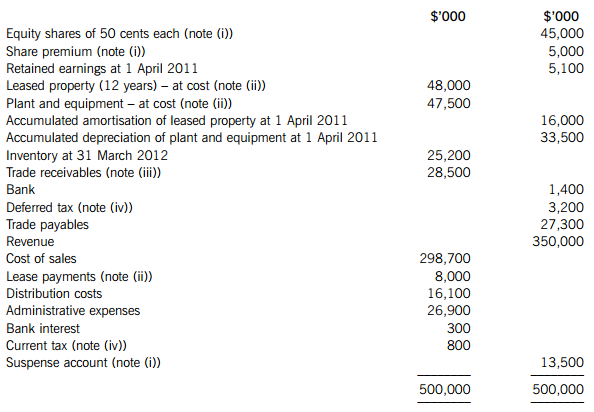

The following trial balance relates to Fresco at 31 March 2012:

The following notes are relevant:

(i) The suspense account represents the corresponding credit for cash received for a fully subscribed rights issue of equity shares made on 1 January 2012. The terms of the share issue were one new share for every five held at a price of 75 cents each. The price of the company’s equity shares immediately before the issue was $1·20 each.

(ii) Non-current assets:

To reflect a marked increase in property prices, Fresco decided to revalue its leased property on 1 April 2011. The Directors accepted the report of an independent surveyor who valued the leased property at $36 million on that date. Fresco has not yet recorded the revaluation. The remaining life of the leased property is eight years at the date of the revaluation. Fresco makes an annual transfer to retained profits to reflect the realisation of the revaluation reserve. In Fresco’s tax jurisdiction the revaluation does not give rise to a deferred tax liability.

On 1 April 2011, Fresco acquired an item of plant under a finance lease agreement that had an implicit finance cost of 10% per annum. The lease payments in the trial balance represent an initial deposit of $2 million paid on 1 April 2011 and the first annual rental of $6 million paid on 31 March 2012. The lease agreement requires further annual payments of $6 million on 31 March each year for the next four years. Had the plant not been leased it would have cost $25 million to purchase for cash.

Plant and equipment (other than the leased plant) is depreciated at 20% per annum using the reducing balance method.

No depreciation/amortisation has yet been charged on any non-current asset for the year ended 31 March 2012. Depreciation and amortisation are charged to cost of sales.

(iii) In March 2012, Fresco’s internal audit department discovered a fraud committed by the company’s credit controller who did not return from a foreign business trip. The outcome of the fraud is that $4 million of the company’s trade receivables have been stolen by the credit controller and are not recoverable. Of this amount, $1 million relates to the year ended 31 March 2011 and the remainder to the current year. Fresco is not insured against this fraud.

(iv) Fresco’s income tax calculation for the year ended 31 March 2012 shows a tax refund of $2·4 million. The balance on current tax in the trial balance represents the under/over provision of the tax liability for the year ended 31 March 2011. At 31 March 2012, Fresco had taxable temporary differences of $12 million (requiring a deferred tax liability). The income tax rate of Fresco is 25%.

Required:

(a) (i) Prepare the statement of comprehensive income for Fresco for the year ended 31 March 2012.

(ii) Prepare the statement of changes in equity for Fresco for the year ended 31 March 2012.

(iii) Prepare the statement of financial position of Fresco as at 31 March 2012.

The following mark allocation is provided as guidance for this requirement:

(i) 9 marks

(ii) 5 marks

(iii) 8 marks (22 marks)

(b) Calculate the basic earnings per share for Fresco for the year ended 31 March 2012. (3 marks)

Notes to the financial statements are not required.

如果结果不匹配,请

如果结果不匹配,请